Inland Empire Commercial Real Estate – Investment Real Estate

Inland Empire Commercial Real Estate, Investment Real Estate, Warehouse Space, Industrial Properties, Vacant Land, throughout Riverside and San Bernardino Counties.

You can Search Properties, Topics on Investment Real Estate, Find and Sell Warehouse Space, For Sale, For Lease, Industrial Properties including Contractor Yards and Truck Yards, Vacant Land, 1031 Exchange throughout Riverside and San Bernardino Counties, a.k.a. The Inland Empire.

My Core Values Include:

- Value – I review every lease deal from an owner’s perspective, enabling our clients to maximize revenue and increase value.

- Accountability – I monitor key performance metrics and provide you with reporting on a regular basis.

- Data Driven – I provide timely advice on valuations, transactions, deal structuring and portfolio strategy.

- Visibility – Reaching the right audience, with the right message, is mission critical to the projects success.

- Results – The bottom line is that results are what matters. I will deliver the results you desire, PERIOD!

For a comprehensive analysis of your situation and to discuss your next move, contact The Warehouse Specialist today or fill out the form…

My Areas of Focus include:

- Highest and Best-Use

- Acquisition

- Sale and Disposition of the properties

- Re-position Strategy

- Energy Efficiency

- Marketing and Lease-up Strategies

- Seller / Landlord Representation

- Tenant / Buyer Representation

- Lease Structure – NNN, Gross, Modified Gross

- Property Tax Appeal

- Logistics

- Environmental

In 2013, Robert was the number two Overall Top Producer commercial earner and is a member of the American Industrial Realtor (A.I.R).

In 2013, Robert was the number two Overall Top Producer commercial earner and is a member of the American Industrial Realtor (A.I.R).

Recent sales include

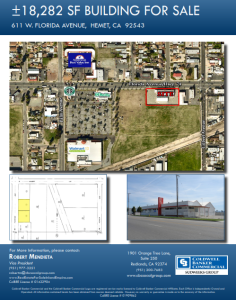

34,000 SF industrial building for $1.7 million in Fontana, CA,

46,840 industrial building for $3.4 million in Riverside, CA

18,000 SF building for $1.9 million in Riverside, CA.

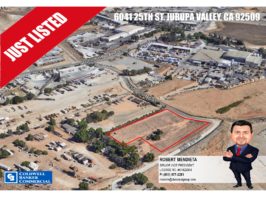

Additionally, Robert recently sold a 64,000 square feet vacant land parcel in Banning, CA for $700,000.

Robert is a leasing specialist, completing over 200,000 SF in industrial lease transactions in 2013.

Some of his notable clients include: Christie Digital Systems, Inc., Automatiq Inc., Grapeland Transport Services, Diverse Steel Inc., Field Sports, Inc., and Fleetserv, Inc.

Prior to joining the commercial real estate industry, Robert worked with investors in the purchase, renovation and disposition of residential properties.

Robert served in the US Army as a Forward Observer to adjust Field Artillery and was stationed in Fulda, Germany within the 11th Armored Calvary

Regiment. In 1990, he won the prestigious “Hero of Hoenfelds”, a two week annual training of simulated warfare. He was the only Forward Observer to

ever win the award. After seeing the Berlin Wall come down, his unit was sent to Saudi Arabia and Kuwait to help liberate Kuwait and participate in Desert

Storm. He served four years of active duty and two years in the National Guard.

Robert attended the Embry Riddle Aeronautical University, with studies in Engineering and Business Management. He resides in the Inland Empire where

he enjoys martial arts, fishing and camping.

In 2013, Robert was the number two Overall Top Producer commercial earner and is a member of the American Industrial Realtor (A.I.R).

In 2013, Robert was the number two Overall Top Producer commercial earner and is a member of the American Industrial Realtor (A.I.R).